Scottish Mortgage Investment Trust (LSE:SMT) is a popular investment trust listed on the FTSE 100 index. It’s a globally-focused fund with a bold central aim, namely to identify and invest in “the world’s most exceptional growth companies“. Unfortunately, growth for the Scottish Mortgage share price has been in scarce supply over the past couple of years.

Before the recent malaise, Scottish Mortgage shares boomed during the pandemic. Many growth stocks in the fund’s portfolio soared amid extremely loose financial conditions. However, as monetary policy has tightened, those share price gains have evaporated since late 2021. Today, Baillie Gifford’s flagship trust trails the five-year performance of the FTSE All-World index that it uses as a benchmark.

Nonetheless, significant volatility is normal for this hyper-growth-oriented fund. Scottish Mortgage adopts a high-risk, high-reward approach and invests on at least a five to 10-year time horizon.

So, with the share price anchored at 688p today, is this potentially an attractive entry point for long-term investors? Here’s what the charts say.

Top holdings

First, let’s look at the fund’s top five stock market positions. Representing 28.5% of the portfolio, these shares are good examples of the companies Scottish Mortgage invests in.

| Stock | % of the portfolio |

|---|---|

| ASML | 7.3 |

| Moderna | 6.1 |

| Tesla | 5.5 |

| Nvidia | 5.0 |

| MercadoLibre | 4.6 |

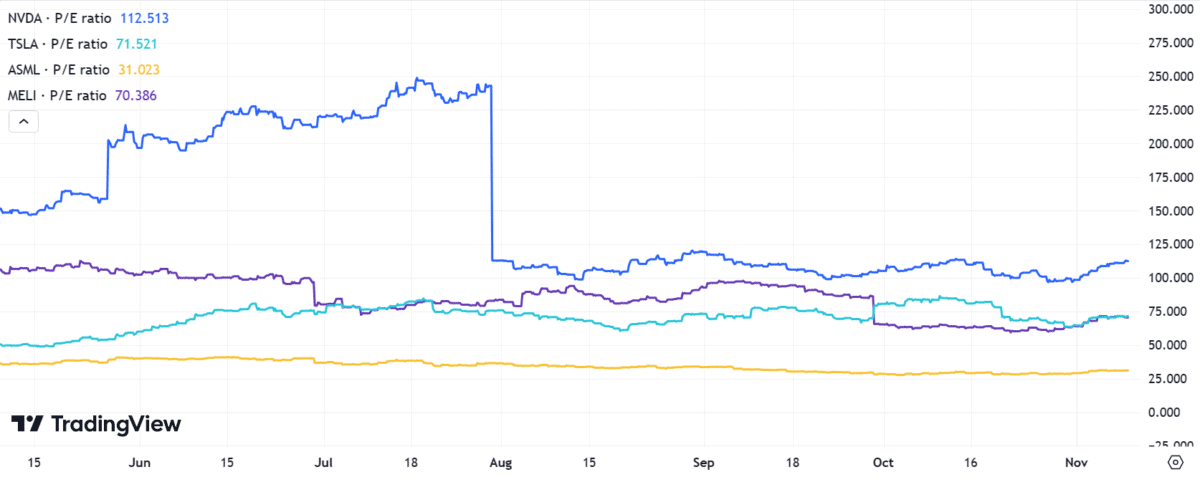

P/E ratios

The valuations of Scottish Mortgage’s top holdings don’t appear particularly cheap — quite the opposite in fact.

For instance, Nvidia trades at a staggering price-to-earning (P/E) ratio above 112 while Tesla and MercadoLibre both sport multiples over 70.

By contrast, the FTSE 100 and FTSE All-World trade for significantly lower multiples below 10 and 16, respectively.

Eagle-eyed readers will have spotted Moderna’s omission from the chart above. The troubled pharma stock has a negative P/E ratio as it’s loss-making at present.

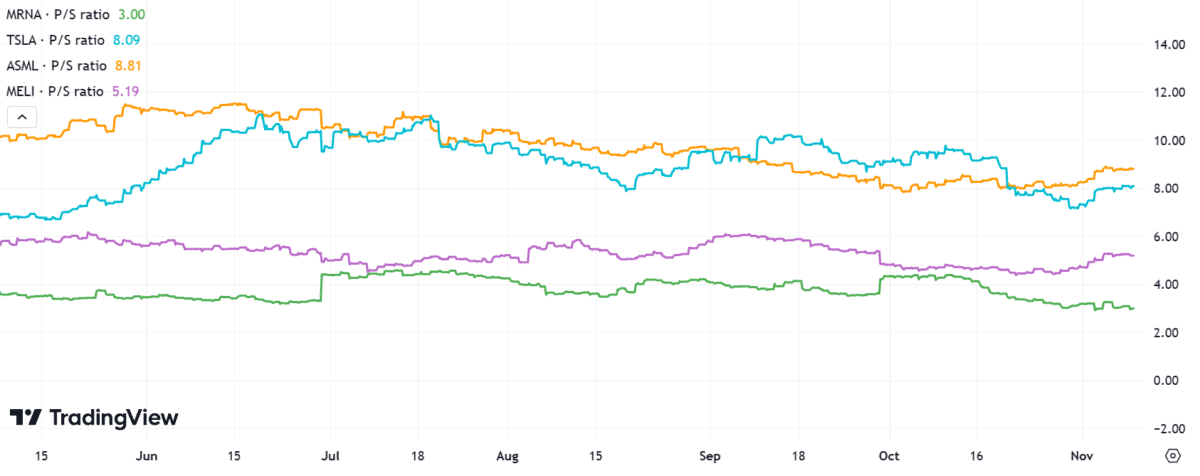

P/S ratios

So, if the holdings don’t look cheap measured by their P/E ratios, how do they stack up using the price-to-sales (P/S) ratio?

Generally, although it’s largely industry-dependent, a P/S ratio between one and two is seen as desirable. Well, Nvidia trades for a P/S ratio above 35!

The remaining quartet have lower P/S ratios than the AI chipmaker. However, they still trade for multiples ranging between three and just below nine.

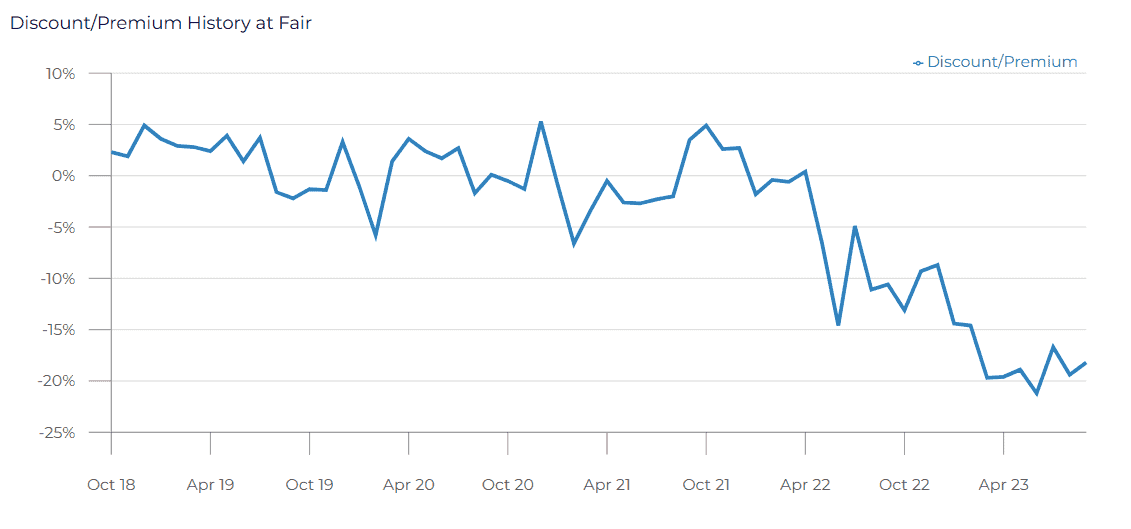

Net asset value

Does this mean Scottish Mortgage shares are expensive?

Not necessarily.

Currently, the trust trades at a -15.4% discount relative to the net asset value of its portfolio. This is well below the five-year average, which gives investors food for thought. It may be short-lived.

It’s worth noting that 30% of the trust’s positions are concentrated in private companies, such as ByteDance and SpaceX. Unlisted shares are notoriously difficult to value, so investors are adopting significant risks as well as potential rewards via Scottish Mortgage shares.

A cheap stock to buy?

If stocks like Nvidia and ASML can ride an AI-fuelled boom or Moderna makes a significant mRNA vaccine breakthrough, the Scottish Mortgage share price may well be undervalued below £7, if not exactly ‘dirt cheap’.

Big potential can justify big valuations. At least, that’s at the heart of the investment trust’s approach. But investors need a high risk tolerance and a long-term mindset.

I’m a shareholder and will be adding to my position here.